![]()

Startup Business

Starting a business can be a daunting task, especially for new entrepreneurs. However, the Indian government has introduced the Startup India Scheme to make it easier for individuals to set up and grow their businesses. This scheme offers various benefits, including tax exemptions, funding opportunities, and mentorship programs, among others.

What is Startup?

A startup is a newly established company, usually small, that is started by a single or small group of people. A startup provides a different good or service that isn’t provided elsewhere similarly, which distinguishes it from other young businesses.

key Takeaways

- Here is a comprehensive guide on how to start a business under the Startup India Scheme

- One of the most significant benefits of the Startup India Scheme is the funding opportunities it offers to startups.

- The scheme provides funding through various government schemes and private investors.

- Startups registered under the Startup India Scheme can avail of various tax benefits.

- Starting a business under the Startup India Scheme can be an excellent opportunity for entrepreneurs.

What is Startup India Scheme?

The Startup India Scheme is an initiative launched by the Government of India in 2016 to promote and support startups in the country. The scheme aims to create a favorable environment for entrepreneurship and innovation and help startups grow and succeed.

Here is a comprehensive guide on how to start a business under the Startup India Scheme:

Step 1: Check your eligibility

The first step to starting a business under the Startup India Scheme is to check your eligibility. To be eligible for the scheme, your business must be registered as a private limited company, a partnership firm, or a limited liability partnership (LLP). It must also be less than seven years old, and its annual turnover should not exceed Rs 25 crore.

Step 2: Register your business

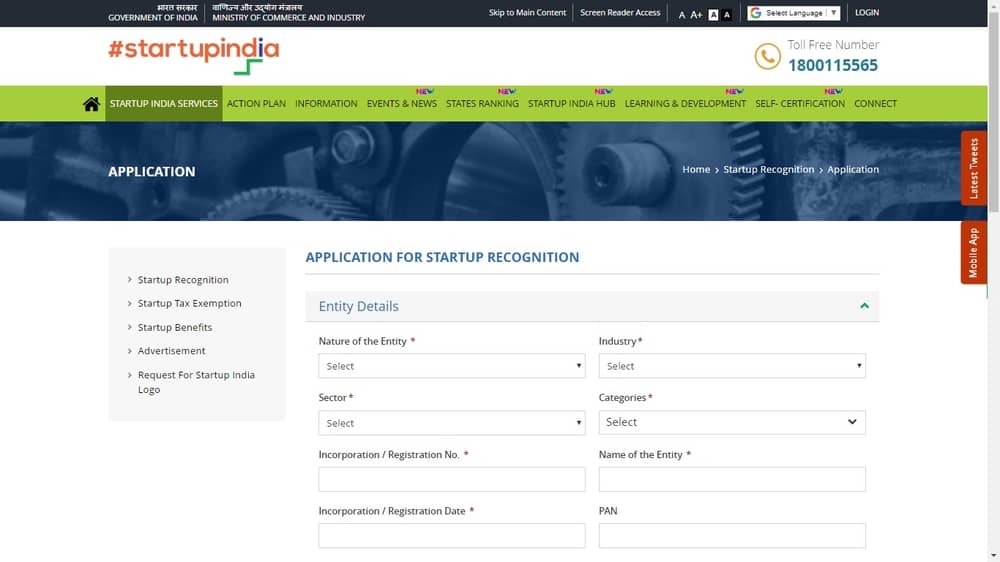

Once you have confirmed your eligibility, the next step is to register your business. You can do this through the Startup India Portal, which is an online platform that facilitates the registration process. You will need to provide some basic information about your business, including its name, address, and type of entity.

Step 3: Get a certificate of recognition

After registering your business, you can apply for a certificate of recognition from the Department for Promotion of Industry and Internal Trade (DPIIT). This certificate is essential because it makes your business eligible for various benefits under the Startup India Scheme. The certificate of recognition is also a mark of credibility that can help you attract investors and customers.

To apply for the certificate of recognition, you will need to submit some documents, including the certificate of incorporation, a brief write-up about your business, and a description of the innovative nature of your products or services. The DPIIT will review your application and issue the certificate of recognition if your business meets the eligibility criteria.

Step 4: Apply for funding

One of the most significant benefits of the Startup India Scheme is the funding opportunities it offers to startups. The scheme provides funding through various government schemes and private investors. Some of the government-funded schemes that you can apply for include the Fund of Funds for Startups (FFS), Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), and Small Industries Development Bank of India (SIDBI).

To apply for funding, you can submit your business plan and other relevant documents through the Startup India Portal or directly to the relevant government agency. Private investors, such as angel investors and venture capitalists, also invest in startups registered under the scheme. You can connect with these investors through networking events, incubators, and accelerators.

Step 5: Access mentorship programs

The Startup India Scheme also offers mentorship programs to help startups grow and succeed. These programs provide guidance and support in various areas, including business strategy, marketing, legal compliance, and financial management. You can access these programs through the Startup India Portal or by joining an incubator or accelerator that is part of the scheme.

Step 6: Avail of tax benefits

Startups registered under the Startup India Scheme can avail of various tax benefits. These benefits include exemption from income tax for three consecutive years, exemption from the capital gains tax, and more. To avail of these benefits, you will need to submit the relevant documents to the income tax department.

Documents Required For Startup India Registration

1) Certificate of Incorporation

2) Copies of the articles of association or the memorandum of association for an LLP or company

3) The information about the directors, including names, phone numbers, and pictures.

4) Social media or website connection for the entity.

5) Details if any about IPR.

6) If a company receives financing assistance from investors, the fund details.

7) A list of any awards or badges of achievement.

8) Mobile number & Email Id

9) Company details

Conclusion

Starting a business under the Startup India Scheme can be an excellent opportunity for entrepreneurs. By following the above steps, you can take advantage of the various benefits offered under the scheme and give your startup the best chance of success. It is essential to do your research, and create a successful business plan.

Contact Kanakkupillai, the leading startup company registration service provider in India. Our team of experts can assist you with the entire private limited company registration process, from obtaining the necessary documents to filing the application with the Registrar of Companies. Contact us now and get your startup company registered hassle-free!