![]()

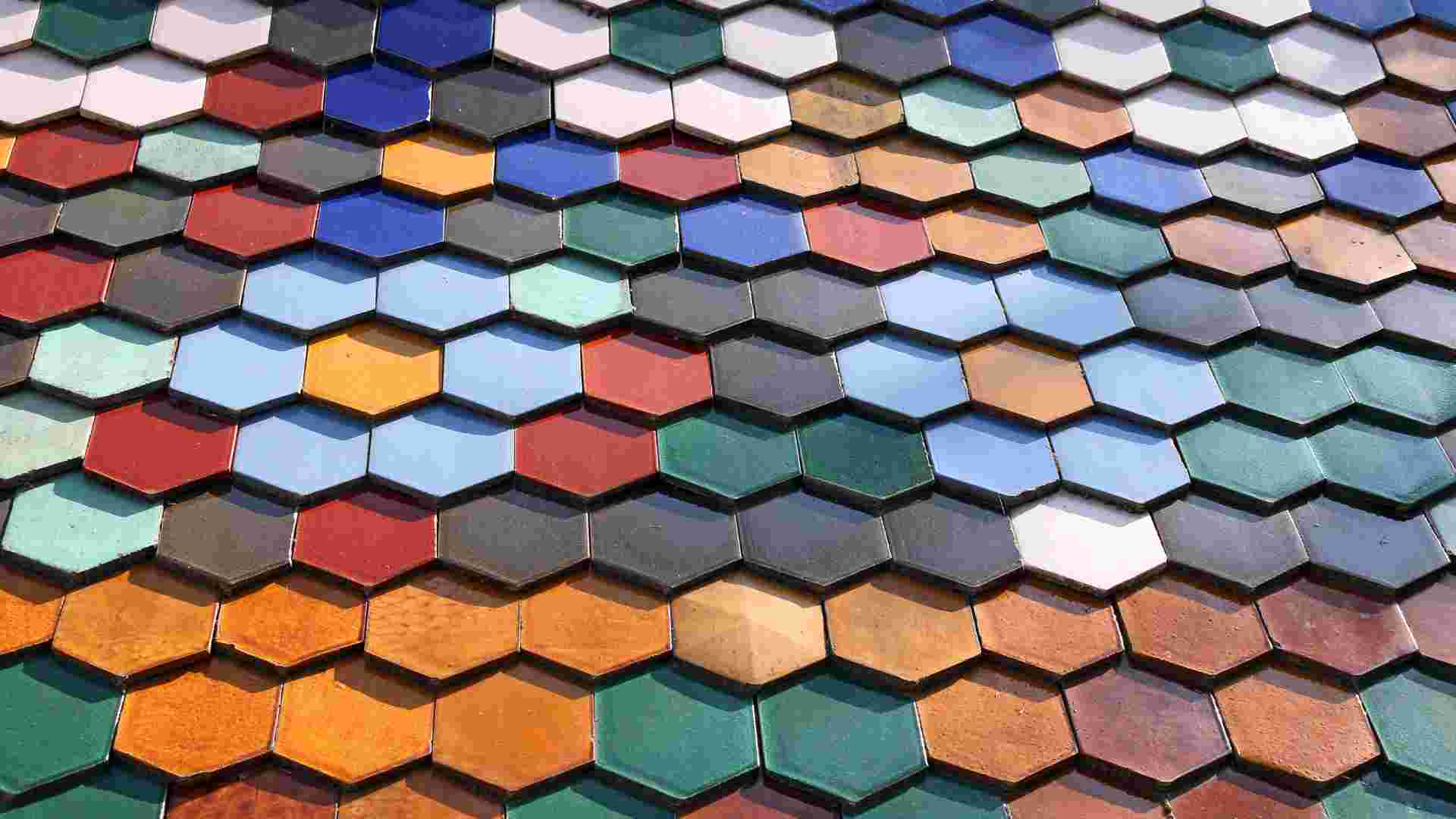

An In-Depth Manual on DGFT Export Incentives for Indian Ceramic Honeycomb Exporters

Export promotion is a crucial aspect of economic development, facilitating international trade and boosting the competitiveness of domestic industries. The Directorate General of Foreign Trade (DGFT) in India plays a pivotal role in promoting exports through various schemes and initiatives. This Blog focuses on the export promotion schemes offered by DGFT Guide: Ceramic Exporters that can specifically benefit ceramic honeycomb exporters in India.

1. Merchandise Exports from India Scheme (MEIS):

MEIS is a popular scheme designed to incentivise exports of specific goods, including ceramic products. Under MEIS, exporters earn duty credit scrips at a percentage of their export turnover, which can be utilised to pay various duties, including customs duties. Ceramic honeycomb exporters can benefit from this scheme by obtaining duty credits based on their export performance.

2. Export Promotion Capital Goods (EPCG) Scheme:

The EPCG scheme allows ceramic honeycomb exporters to import capital goods, including machinery and equipment, at zero or concessional customs duty. This is particularly advantageous for exporters looking to upgrade their technology and enhance their manufacturing capabilities. By availing of the EPCG scheme, exporters can enhance the efficiency and quality of their production processes.

3. Focus Product Scheme (FPS): DGFT Guide: Ceramic Exporters

The FPS is aimed at promoting the export of specific products, and ceramic honeycombs may fall under the eligible categories. Exporters can earn duty credit scrips based on the FOB value of their exports, which can be used to pay duties on imported goods. This scheme encourages exporters to focus on high-value products, ultimately boosting the export of ceramic honeycombs.

4. Export Oriented Units (EOU) Scheme:

The EOU scheme is designed to promote exports by allowing units to be set up to produce goods exclusively for export. Ceramic honeycomb exporters can establish EOUs to benefit from tax exemptions, duty-free imports, and simplified procedures. This scheme fosters a business environment conducive to export-oriented production.

5. Advance Authorisation Scheme:

The Advance Authorisation Scheme enables ceramic honeycomb exporters to import raw materials, components, or intermediates without paying customs duties. This is particularly beneficial for industries where the cost of raw materials significantly impacts competitiveness. Exporters can avail of this scheme to reduce production costs and enhance their global competitiveness.

6. Duty Drawback Scheme:

The Duty Drawback Scheme aims to refund the customs duties paid on imported raw materials used in the manufacturing of exported goods. Ceramic honeycomb exporters can claim a drawback on duties paid, providing them with a financial incentive to boost exports. This scheme helps in maintaining the competitiveness of Indian products in the global market.

7. Market Access Initiative (MAI):

The MAI scheme supports exporters in exploring and expanding markets by providing financial assistance for activities such as market research, participation in trade fairs, and promotional campaigns. Ceramic honeycomb exporters can utilise the MAI scheme to increase their market presence and find new opportunities in international markets.

8. Status Holder Incentive Scrip: DGFT Guide Ceramic Exporters

The Status Holder Incentive Scrip is awarded to exporters based on their export performance. Exporters achieving status as Star Export House, Star Trading House, or Star Star Trading House are eligible for these incentives. Ceramic honeycomb exporters can benefit from this scheme by gaining recognition for their export achievements and receiving additional incentives.

9. National Export Insurance Account (NEIA):

NEIA provides insurance cover to Indian exporters to protect them against payment risks and facilitate the expansion of export credit. This scheme ensures that ceramic honeycomb exporters can confidently explore new markets without the fear of payment defaults, promoting secure and sustained international trade.

10. Services Exports from India Scheme (SEIS):

While ceramic honeycombs are tangible goods, exporters engaged in the export of related services can benefit from the SEIS. This scheme provides service providers with duty credit scrips based on their net foreign exchange earnings, promoting the export of services associated with ceramic honeycomb manufacturing and technology.

Conclusion: DGFT Guide: Ceramic Exporters Schemes in India

DGFT’s export promotion schemes offer a comprehensive framework to support DGFT Guide: Ceramic Exporters in India. By strategically leveraging these schemes, exporters can enhance their competitiveness, explore new markets, and contribute to the growth of the Indian ceramic industry on the global stage. It is essential for exporters to stay updated on the evolving policies and schemes of DGFT to make the most of available opportunities and ensure sustainable export growth.