Are you planning for your future to save a specific part of your income? Then, there are numerous ways available to invest your savings and secure a better future. One of the best ways to invest is in a provident fund, which helps you lead a secure retired life. A provident fund is an investment in which the employer/government and the employee contribute a certain amount for the employee’s benefits.

You are familiar with the bank account number, which serves as a unique identification number that helps keep your money and assets safe. Like a bank account number, a UAN (Universal Account Number) number identifies your Employer Provident Fund (EPF) deposits and helps to keep them safe. The Universal Account Number will maintain employees’ information related to their EPF account. Here, let us know the information about Universal Account Number Login, how to generate UAN, and check UAN status.

Attention EPF members!!

It is hereby notified that with effect from 1st April 202,1, the IFSC of Andhra Bank, Oriental Bank of Commerce, Allahabad Bank, Syndicate

Bank, United Bank of India, and Corporation Bank have become invalid. The member needs to obtain the correct IFSC code through their employer, as no online claim filing will be facilitated until then. Please get the correct IFSC code from your bank and upload the details for approval. This will ensure that banks do not return the member’s claim amount.

What is a UAN Number?

The acronym UAN stands for Universal Account Number, which comprises information about all Member IDs of an employee. PF Number comprises all PF information and details of the PF transaction of an employee with the issuing organization. UAN is a permanent number that is eligible throughout an individual’s lifetime.

A Universal Account Number is a 12-digit identification number that maintains details of provident fund investments. The Ministry of Labour and Employment issues this number and assigns it by the Employees’ Provident Fund Organisation (EPFO). Your EPF account will be linked to UAN to simplify EPF withdrawals and transfers.

EPFO assigns two separate UAN numbers to you and your employer. It provides a new identification number that links to your existing UAN. Once the UAN number is generated, it stays consistent even if you shift from one company to another. Every time you shift to a new company, you need to inform EPFO.

How to generate a UAN?

UAN is generated by the company when the employee joins their service sector. If the company has 20 or more employees, it’s their responsibility to generate the UAN. If the employee already has a UAN assigned from their previous company, they need to provide the details to the new employer. The employer has to follow the steps below to generate a new UAN for the employee.

- Log in to the EPF Employer Portal using the company ID and password

- Click on the “Register Individual” in the Member section

- Enter the employee’s details, including Aadhaar, PAN, and bank account information.

- Check all details and approve in the “Approval” section

- Finally, EPFO generates a new UAN, and the employer can successfully link the PF account with the employee’s UAN.

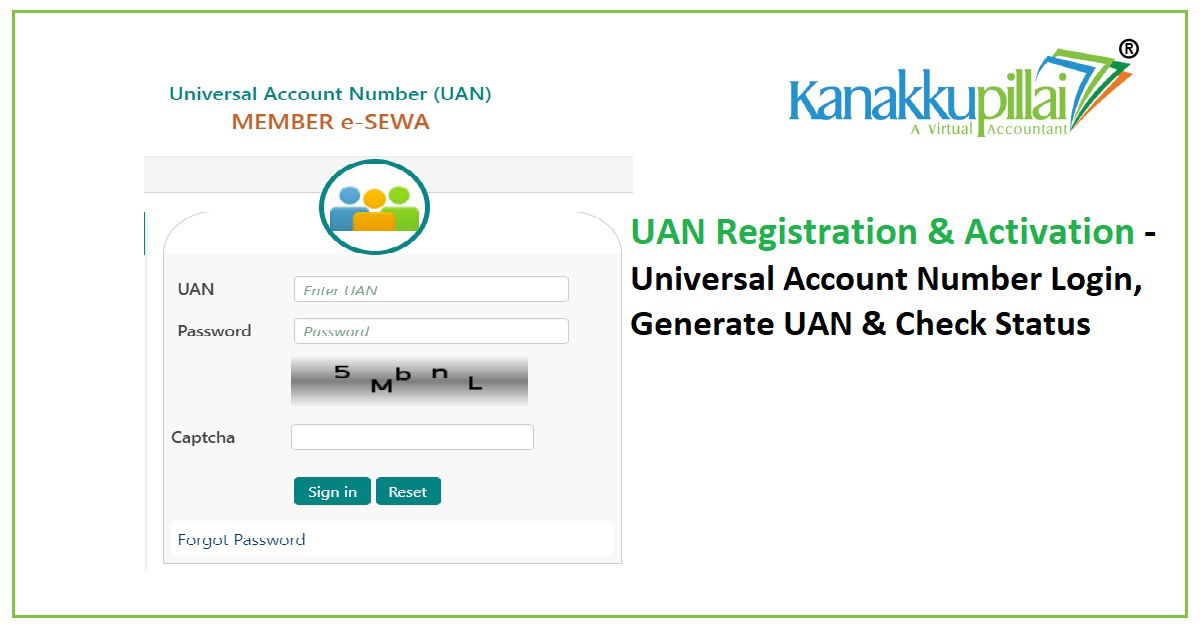

How to activate and log in to the EPFO website using UAN?

To activate your UAN, you will need to have your Universal Account Number and PF member ID.

Below are the steps to activate UAN on the EPFO portal

- Step 1: Visit the EPF member portal and click on ‘For Employees’ under the Our Services tab on the dashboard.

- Step 2: Under the service section, click on ‘Member UAN/Online Service.’ You will be directed to the UAN portal.

- Step 3: On the UAN displayed portal, enter your UAN number, PF member ID, and mobile number, and captcha characters.

- Step 4: Click on Sign In. You will receive the OTP on your registered mobile number.

- Step 5: Enter the validated OTP and activate UAN.

- Step 6: Once your UAN is activated, you will receive a password on the given mobile number to access your account.

How do I check UAN status?

If you want to check your UAN status, below are the steps that you need to follow:

- Step 1: Visit the EPF member portal and under ‘Services’ on the dashboard, click on ‘For employees’.

- Step 2: In the Services section, click on UAN online service (OCS/OTCP)

- Step 3: Click on ‘Know your UAN status’ in the ‘Important Links’ section.

- Step 4: Enter your member ID, Aadhaar number, PAN or PF number, and other basic details like name, mobile number, date of birth, and email ID. Then, enter the given captcha characters.

- Step 5: Click on the ‘Get Authorization Pin.’

- Step 6: An OTP is sent to your registered mobile number, and enter the validated OTP

- Step 7: Your UAN number and the status will be sent to your registered mobile number.

What are the documents required to open a UAN?

If you shift your job to a registered company, you need to submit the following documents to create an EPF account.

- Bank Details: Name, Account Number, IFSC code, and branch name.

- ID proof: Any nationality identifies the card that is affixed with a photograph, such as the Aadhaar card, voter ID, driving license, passport, etc.

- PAN card: Link your PAN to the UAN.

- Aadhaar card: It is mandatory to link your Aadhaar number to your bank account and mobile number.

- Address proof: Ration card or any ID proof.

- ESIC card: If any.

Ways to check your PF balance with UAN

Generally, employers share your PF balance status at the end of each financial year. However, you don’t have to wait long, and you can access your convenience using the UAN number by following a few simple steps.

- Check PF Balance using the EPFO Portal

- Check PF Balance using SMS Facility

- Check PF Balance using Missed Call Facility

- Check PF Balance using UMANG App

UAN Passbook

Once you have registered on the unified member portal, you can view your passbook online once you can access your passbook online through the portal.

Steps to follow to view your passbook online:

- Step 1: Visit the EPF member portal and click on ‘Services.’ Click the ‘For employees’ tab under the ‘Services’ tab.

- Step 2: In the service section, click on ‘Member Passbook.’

- Step 3: Enter your User Name and password and sign in to access your account.

Now, with the advent of technology, you can easily avail EPFO services by using an app. Just download from the App Store, Google Play Store, or UMANG website.

Features and benefits of UAN

- UAN centralizes employee data in the country

- This unique number reduces the burden on companies to verify employees.

- This account enables the EPFO to extract bank account details and conduct KYC without the assistance of employers.

- Easily track multiple employee switches.

- With the introduction of the UAN, early withdrawals have reduced considerably.

Features of UAN

-

UAN remains the same even when your job changes

UAN remains the same throughout your employment years, and every time you change your job, your new employer will assign you a new PF Member ID. This UAN brings all your PF accounts under one roof, which is a UAN number and remains unchanged for a lifetime. When you change jobs, you should notify your new employer of your UAN number. Then your new PF account is linked with your UAN.

-

The employer assigns the UAN number

If you work in an organization that contributes to EPF, your employer allocates the UAN number to your account. Generally, the employer will provide you with the number.

If you don’t have it, to obtain your UAN number, you should log in to the UAN Portal and register your details, including PAN, Aadhaar, and mobile number.

-

If you have two UANs, you should solve the matter

If you have more than one UAN, in case you forget to inform the new employer of your existing UAN, or your previous employer has not updated your date of exit. If this happens, you should do one of the following:

Report to the EPFO office

Request transfer of the old UAN to the new UAN

-

UAN helps to change your personal details easily

Not every job is permanent, and whenever you change jobs or transfer to another city, you need to change your phone number and contact details. Now, at the UAN portal, you can edit your personal details easily at your convenience.

How do you edit the personal details?

- Log in to the UAN member portal.

- Go to the ‘Profile Menu’

- Select ‘Edit Mobile No.’ and make the necessary changes.

Once you have successfully altered, the notification will be sent to your registered mobile number and email ID.

-

UAN simplifies the system for withdrawing money

As all your member IDs are linked to one UAN, it enables you to access your previous PF accounts easily and helps you transfer or withdraw funds from those accounts. This system saves your time and helps to track your payments.

Advantages of UAN to employees

- Every new PF account for a new job will come under a single unified account.

- Using the UAN number, it is easier to withdraw money, either fully or partially, online.

- By using this unique account number, the employee can transfer the PF balance from the old account to a new one.

- You can easily download the PF statement instantly for visa purposes, loan security, etc., using the UAN account number or by logging in using the member ID.

- If the UAN is already Aadhaar and KYC-linked, there is no need for a new company to validate your profile.

- UAN ensures that employees cannot withhold or access the PF money.

- UAN lets employees know that their employer is depositing their contributions regularly in the PF account.

- UAN ensures that the employee’s money is safe throughout their career.

Frequently Asked Questions

- How to Change the Mobile Number in UAN Without Logging In?

- Visit the UAN website

- Click on Forgot Password

- Enter UAN and display Captcha, then click submit

You will be directed to the forgot password page. If you need to change your mobile number, enter the UAN number and click the No option. After that, you will see the Enter your Details screen, which asks for your Name, Date of Birth, and Gender. After entering, click on verify. The Validate Against screen will extend. You have to choose an Aadhaar or PAN number and enter the selected number. And then click verify.

If all your details are entered, they are correct. The validated details message will be displayed in green color. Then, enter the new mobile number and click OTP. You will receive the OTP on your newly registered mobile number. Enter OTP in the field, and then you need to create a new password. The password should be in the required format. Click submit

Your mobile number will be successfully changed.

- How to log in to a PF account with a UAN number?

- Visit the EPFO online portal

- Enter UAN, Password, and Captcha

- Click Sign In.

- How to log in to the UAN number for the first time?

When you register your UAN, you will receive the OTP on your registered mobile number. Click ‘I Agree’, enter the OTP, and click ‘Validate OTP and Activate OTP’. On UAN activation, you can access your account using the password.

- How to reset the UAN login password?

- Visit the UAN Portal

- Click ‘Account Settings’ from the Homepage

- Enter the old password and the new password twice

- Click on update

- How to create a UAN login ID?

- Visit the UAN member portal.

- On the bottom right of the page, click the online Aadhar-verified UAN allotment link

- Enter your Aadhar number and wait for the OTP that is sent to your registered mobile number

- Enter OTP and wait for the system to fetch your details from the Aadhar database

- Click to get your UAN and receive it through SMS

- How to log in to EPF with UAN?

- Visit EPFO Portal

- Enter UAN, Password, and Captcha

- Click Sign in

- What is the format for my UAN password?

The password will be created by the user while activating their UAN. The password should be 8-25 characters long; it should have 1 special character, at least one alphanumeric uppercase character, and one lowercase alphanumeric character.

E.g., Bsbc@896

- What are the facilities available in the UAN Member Portal?

- Download your passbook

- Download your UAN card

- View previous member IDs

- Update your KYC details

- Check eligibility for transfer claims

- Update or edit personal details

- How do I upload the scanned copy of the KYC document?

First, scan the KYC document and save it in JPEG, GIF, or PNG format. The size of the scanned copy should be below 300 KB.

In the ‘Profile’ menu of the UAN Member Portal, select ‘Update KYC Information. Upload the documents, and it will remain pending until the employer approves them digitally.

- If the personal details on a UAN Card are incorrect, how can I correct them?

Members can correct the details by submitting proof of documents to the employer. The employer will verify and submit documents to the concerned field office.

Wrapping it up

Hope you have understood the concept of UAN registration and activation. The UAN number is the best way to keep your PF funds secure and accessible throughout your career. Now, make use of the digital platform to maintain and supervise your money comfortably.