CIBIL Credit Report: What is CIBIL Score

How to check it online Free?

What is CIBIL Score?

Credit Information Bureau (India) Limited (currently known as TransUnion CIBIL), is a credit information company which maintains the records of the credit details of various borrowers ranging from companies to individuals. They obtain relevant details of the credits extended by various financial institutions to its borrowers, on a regular basis. The data collected is then used by the company to generate and issue a credit report and a relevant credit score, generally known as CIBIL Score.

To explain in a simple manner, this score is similar to the marks obtained by a student, which is derived completely based on his performance in the past examinations. With this mark we can assess the capability of the student in terms of whether he can perform well if he takes up any further exams in the future. In other words, with this mark, we can ascertain whether he will ‘Pass’ or ‘Fail’ in his future exams. In terms of the financial environment, the student here is the borrower; the past exams are the past loan/ credits which he has taken; marks obtained from past borrowing activity is CIBIL Score; future exams are his future borrowings and ‘Pass’ refers to prompt and complete repayment of his borrowing while ‘Fail’ refers to default on part of the borrower to repay the credit taken by him.

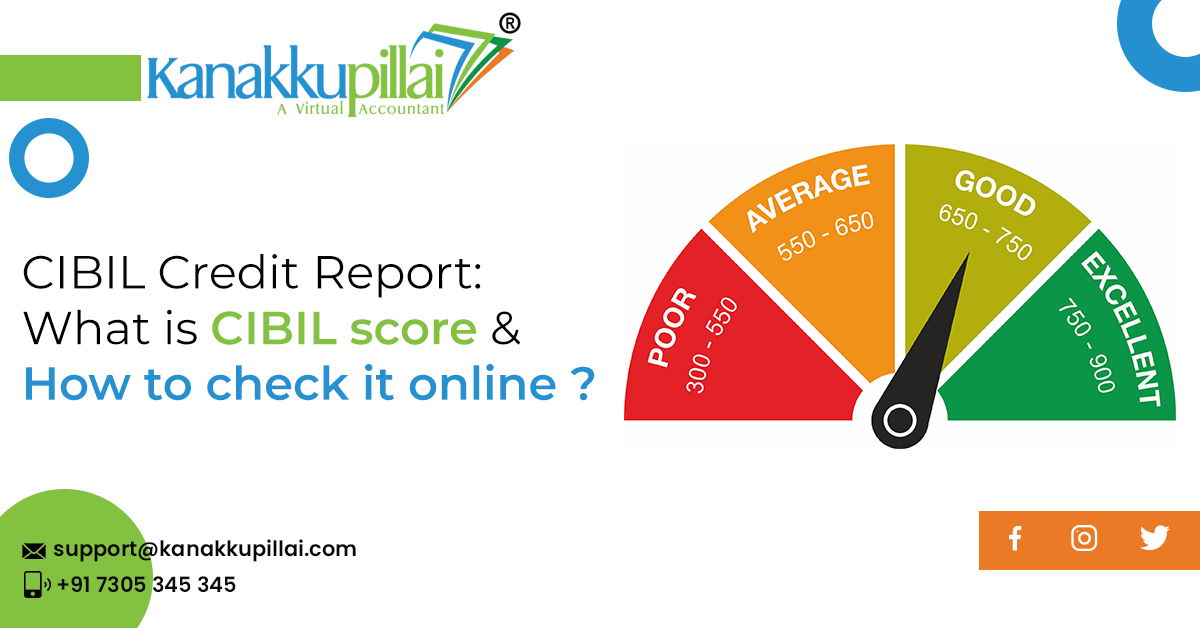

Your credit score is often referred to as your CIBIL score because CIBIL stands for the name of the credit bureau that creates the score. CIBIL used to refer to the Credit Information Bureau (India) Limited. In 2000, it partnered with US-based TransUnion and the company is now called TransUnion CIBIL Ltd. CIBIL Score is a 3-digit numeric summary of your credit history, rating and report, and ranges from 300 to 900. The closer your score is to 900, the better your credit rating is. A good CIBIL score is a score between 700-900 that instills confidence in the lender and proves your sound creditworthiness to the lender. Log on to the CIBIL website and click on the ‘know your score’ tab to get a personalized credit score. Fill an online form which requires you to include details such as your name, date of birth, income, identity proof, address and phone number, in addition to the loans taken by you.

CIBIL Score vs CIBIL Credit Report

CIBIL Score |

CIBIL Credit Report |

|---|---|

| – It is 3 digits score | – It is a detailed report |

| – It ranges from 300 to 900: higher the score more is the chance of the credit application being approved. This score is a part of the Credit Report. | – It contains complete details of the borrower, such as his past borrowings, defaults made (if any), personal information, etc. It also contains the CIBIL Score |

| – It is derived based on the past performance of the borrower, such as previous borrowings, regularity in repayment of the same, etc. | – The report is derived using the relevant details obtained from various financial institutions. |

| – It is based on past 24 months of credit behavior | – It includes credit history of past 36 months. |

| – It is 3 digits score | – It is a detailed report |

Why and Who should obtain a CIBIL Score?

- Any person or an organization who intends to get any kind of credit/ borrowing from a financial institution such as housing loan, personal loan, credit card, etc. shall be reviewed based on their CIBIL Score. However, for a person/ organization who is a new credit customer (that is, he has never borrowed money from financial institutions in the past), a CIBIL score won’t be available and hence it may not be required.

- The CIBIL score acts as a measurement of the future capability of the borrower in terms of repaying the borrowings. The past borrowings of the borrower, promptness in repayment, income details, etc. are considered as an indicator of his future actions with respect to repayment of the dues. The higher the score, higher is the chance of credit application being approved. The score ranges from 300 to 900 and usually a score below 750/ 700 makes it difficult to obtain the credit and anything above 750 makes a good chance for the borrower to obtain the credit. In some cases, a higher CIBIL score can also provide the borrower an opportunity to obtain the credit at a lower interest rate, compared to normal interest rate

How to maintain a good CIBIL Score (or)

Factors affecting CIBIL Score

A good CIBIL score will always ensure faster and easy approval of credit application and in some cases facilitates to get credit at lower interest rates. But how should a borrower ensure that he has a good CIBIL score?

-

Prompt repayment of borrowing instalments: –

Be it a housing loan, personal loan, credit card dues or any other borrowing, a timely repayment of the instalments always helps in securing a good CIBIL Score. When it comes to situations like credit card dues, ensure you settle the bill fully and not just pay the ‘minimum amount due’.

-

Proper mix of Unsecured & Secured loans: –

Loans such as credit card dues, personal loan, etc. are often unsecured (that is, the borrower does not pledge any asset to borrow). Hence, having too many unsecured loans may not be favourable. Therefore, having a reasonable mix of secured loan such as house loan, vehicle loan, etc., where an asset is pledged against the loan is also good for obtaining a good CIBIL score.

-

Review your borrowings regularly: –

Reviewing your CIBIL score and credit report on a regular basis may help you ensure that there are no discrepancies in your CIBIL score. In case if you find anything issue with your borrowings, CIBIL score or other details contained in the credit report, you can contact the relevant authority on a timely basis, so as to avoid any further problems.

-

Ensure reasonable/ low credit usage: –

Just because you have a higher credit limit, it doesn’t mean that you can borrow more until you use the full limit or breach the limit. Plan your expenses properly and ensure that you use your credit limit is utilized for necessary purpose and also stay reasonable, especially within the limit.

Free CIBIL Score from Credit Information Bureau (India) Limited [TransUnion CIBIL]

STEP 1: Visit website of TransUnion CIBIL: Credit Score | Credit Report | Loan & Debt Solutions | CIBIL

STEP 2: If you are already a member, click on ‘Log in now’ and after filing the User ID and password, you can access your account where you can check for your CIBIL Score & credit report. and It is Free for Members.

[su_note note_color=”#6aadd1″ text_color=”#ffffff”]NOTE: If you are not a member and still want to check you CIBIL score through the website of Credit Information Bureau (India) Limited, you need to pay for the same. Depending on the requirements, one can choose the relevant plan and pay for the same, to get his CIBIL score and credit report. For this, after vising the above website, you can click on ‘Get your CIBIL Report & Score’ option given on the right top corner of the website. [/su_note]

CIBIL Score: The various plans of are as follows:

Subscription Type |

Period of Subscription |

Amount |

|---|---|---|

| Basic | 1 month | Rs. 550/- |

| Standard | 6 months | Rs. 800/- |

| Premium | 12 months (1 year) | Rs. 1,200/- |