![]()

Micro, Small, and Medium-Sized Enterprises, or MSMEs, are companies with modest workforces and capital investments. MSMEs are a substantial part of the Indian economy, contributing significantly to both employment and industrial production. Over 110 million people are employed by India’s 63 million MSMEs, according to official statistics.

Udyam MSME Registration plays a significant role in the expansion of the manufacturing, service, and export industries as well as the economy of India. Millions of people view them as a source of employment, particularly in rural regions, and they may aid in eradicating poverty and fostering inclusive growth.

The Indian government has started a number of programmes to help the growth of MSMEs, such as the MSME Building Act, which calls for the building of a framework to support and promote these companies. The government has also put in place programmes to help MSMEs have access to markets and infrastructure, as well as funding, technology, and training.

Key Takeaways

- MSMEs are small companies with modest workforces and capital investments.

- Udyam MSME registration is important for Indian businesses because it provides benefits to MSMEs.

- Aadhaar card is important for Udyam MSME registration to ensure authenticity and identify the individual registering the business entity.

- Accuracy and completeness are essential when filling out the Udyam registration form.

- MSMEs are essential to the Indian economy, contributing to employment generation, export promotion, and overall growth and development.

- Udyam registration provides access to government schemes and benefits, including subsidies, tax exemptions, credit facilities, and other incentives essential for MSME growth.

Definition and significance of Udyam MSME registration

To make it easier for MSMEs to register, the Indian government created the Udyam MSME registration procedure. Businesses may register themselves as MSMEs and take advantage of a number of government perks through an online registration procedure.

It is important for MSMEs to register with Udyam since it gives them a special identification number that allows them to participate in various government programmes, subsidies, and incentives. Additionally, it makes it easier for them to participate in government procurement, which can aid in business growth and revenue generation. The Udyam MSME registration process is a crucial first step for MSMEs to build their credibility and gain access to the resources they require to expand and prosper.

Importance of Udyam MSME registration for businesses in India

Udyam MSME registration is of significant importance for businesses in India as it offers a variety of benefits to Micro, Small, and Medium Enterprises (MSMEs). Here are some of the key benefits of Udyam MSME registration:

- Access to government schemes and incentives:

Registered MSMEs have access to a variety of government programmes, incentives, and grants, including loan guarantees, grants for adopting new technology, and reimbursement of costs associated with acquiring quality certifications.

- Easier access to credit:

MSMEs with Udyam registration are eligible for a variety of credit facilities, including priority sector financing and collateral-free loans, at lower interest rates than MSMEs without registration.

- Increased visibility and credibility:

Udyam registration gives MSMEs a special identification number and a certificate of registration, which aids in establishing their legitimacy and raising their exposure among prospective clients and suppliers.

- Ease of doing business:

The registration procedure is simple and conducted online, which lessens the administrative load on MSMEs and frees them up to concentrate on expanding their operations.

- Access to government procurement:

Registered MSMEs are granted preference in government procurement, which may be a significant source of income and aid in business growth.

Udyam MSME registration can help businesses in India to access a range of benefits and support, enabling them to grow and thrive in a competitive marketplace.

Understanding Udyam MSME Registration

Definition and eligibility criteria for Udyam MSME registration

Udyam MSME registration is a process of registering a Micro, Small, or Medium Enterprise (MSME) in India, as per the guidelines set by the Ministry of Micro, Small and Medium Enterprises. The registration process is entirely online and free of cost.

The eligibility criteria for Udyam MSME registration are as follows:

- Type of business entity: The business must be registered as a:

- Sole Proprietorship,

- Partnership Firm,

- Hindu Undivided Family (HUF),

- Private Limited Company,

- Limited Liability Partnership (LLP) or any other form of legally recognized entity.

- Investment in Plant and Machinery or Equipment: Investments in plant, machinery, or equipment for manufacturing or production-based firms should total up to Rs. 50 lakhs for Micro Enterprises, Rs. 50 lakhs to Rs. 5 crores for Small Enterprises, and Rs. 5 crores to Rs. 10 crores for Medium Enterprises.

- Annual turnover: Aadhaar card: The proprietor, partner, or authorized signatory should have a valid Aadhaar number for the registration process.

- PAN card: The business entity must have a valid PAN card.

- GST registration: If applicable, the business entity should have a valid GST registration.

These eligibility criteria were introduced in July 2020 and are based on self-declaration by the businesses during the registration process.

Advantages of Udyam MSME registration for businesses

Udyam MSME registration provides various advantages to businesses in India. Here are some of the key advantages:

- Access to government schemes and incentives: Registered MSMEs are eligible for a number of government incentives, including loan guarantees, grants for adopting new technology, and reimbursement of costs associated with acquiring quality certifications.

- Lower interest rates on loans: Compared to non-registered MSMEs, registered MSMEs are eligible for a variety of credit facilities, including priority sector financing and loans without collateral.

- Priority in government procurement: Registered MSMEs are granted preference in government procurement, which may be a significant source of income and aid in business growth.

- Credibility: Registered MSMEs are granted preference in government procurement, which may be a significant source of income and aid in business growth.

- Easier access to markets: Udyam registration may assist MSMEs in attending trade shows and exhibits, giving them chances to promote their goods and services and broaden their clientele.

- Simplified regulatory compliance: Reduced documentation requirements and streamlined regulatory compliance procedures are advantages for registered MSMEs.

Udyam MSME registration can provide businesses with various benefits and support, enabling them to grow and compete in a challenging business environment.

Comparison of Udyam MSME registration with other registration processes

Udyam MSME registration is a simplified online process of registering a Micro, Small or Medium Enterprise (MSME) in India. It replaced the earlier registration processes, such as Udyog Aadhaar Registration and EM-II registration. Here is a comparison of Udyam MSME registration with other registration processes:

- Udyog Aadhaar Registration: The prior MSME registration procedure in India, known as Udyog Aadhaar Registration, required the business owner to complete an online form and submit basic information about their operation. The procedure is more simplified, and the qualifying requirements are explicitly stated with Udyam MSME registration, nonetheless.

- EM-II registration: For companies operating in the manufacturing sector, the EM-II registration procedure served as a means of MSME registration. Businesses must fill out a form and physically deliver it to the District Industries Centre as part of the registration procedure. Businesses may register for an Udyam MSME fully online, from any location, without having to submit any paperwork physically.

- Company registration: The process of forming a private limited company or a limited liability partnership is known as company registration. Compared to Udyam MSME registration, the procedure has more stringent documentation and compliance requirements. The registration of an Udyam MSME is less complicated and requires fewer papers.

Documents Required for Udyam MSME Registration

List of documents required for Udyam MSME registration

To register for Udyam MSME, the following documents are required:

- Aadhaar card of the proprietor, partner or authorized signatory

- PAN card of the business entity

- Business address proof document such as electricity bill, water bill, property tax receipt, etc.

- Bank account statement or cancelled cheque

- Details of the business such as type of entity, industry sector, number of employees, etc.

It is important to note that these documents must be uploaded online during registration. It is also recommended to ensure that all documents are valid, legible, and in the business entity’s name. The registration process is entirely online, and no physical documents need to be submitted.

Explanation of the purpose and importance of each document

Aadhaar Card and MSME

Aadhaar card is one of the key documents required for registering for Udyam MSME in India. Aadhaar is a unique identification number issued by the Government of India to its citizens and residents. The purpose of providing the Aadhaar card during the Udyam MSME registration process is to verify the identity of the business entity’s proprietor, partner, or authorized signatory.

The Aadhaar card is an important document as it contains biometric data such as fingerprints and iris scans, making it a secure and reliable identification method. It also serves as proof of identity and address, as the Aadhaar card contains the individual’s address.

The importance of Aadhaar card for Udyam MSME registration because it helps ensure that the registration process is genuine and that a valid and verified individual is registering the business entity. This helps to prevent fraudulent registrations and ensures that the benefits of the registration process are provided to genuine MSMEs.

Overall, Aadhaar card is an important document for Udyam MSME registration, as it helps ensure the registration process’s authenticity and provides a reliable method of identifying the individual registering the business entity.

PAN Card and MSME

A PAN (Permanent Account Number) card is a unique identification number issued by the Income Tax Department of India to individuals and entities. It is a 10-digit alphanumeric code that serves as an identity proof and is mandatory for various financial transactions, including tax-related activities.

In the context of registering for Udyam MSME (Micro, Small and Medium Enterprises), the PAN card is an essential document as it is required to establish the identity and legal status of the business entity. The Udyam registration process is online, and the applicant needs to provide their PAN card details while filling up the registration form.

The PAN card helps to link the Udyam registration with the business entity’s tax-related activities, such as filing income tax returns, paying taxes, and claiming tax benefits. It also helps in avoiding duplicate registrations and frauds by ensuring that every business entity has a unique PAN number.

Therefore, the PAN card is of significant importance for registering for Udyam MSME, as it serves as a primary document to establish the business entity’s identity and legal status and links the Udyam registration with the tax-related activities of the entity.

Proof of business address and MSME

A business address proof document is a crucial requirement for registering for Udyam MSME as it establishes the business’s physical location. This document serves as proof of the business’s existence and allows the government to verify the business’s details. It could be in the form of a rent agreement, electricity bill, or property tax receipt. Having a valid business address proof document ensures the business’s credibility and helps prevent fraudulent practices in the MSME sector.

Bank Statement or cancelled cheque and MSME

When registering for Udyam MSME, a bank account statement or a cancelled cheque is required as a document to verify the bank account details of the applicant. The bank account statement shows the transactions and balance in the account, while a cancelled cheque indicates the account holder’s name, account number, and IFSC code. These documents help in verifying the authenticity of the applicant’s bank account and ensure that the benefits provided by the government under the MSME scheme reach the rightful beneficiary.

Tips for preparing and submitting the documents for Udyam MSME registration

Preparing and submitting the correct documents is crucial for a successful Udyam MSME registration. Here are some tips to ensure you have everything in order:

- Review the document requirements carefully: Make sure you know exactly which documents are required for registration, and check that you have all the necessary information.

- Keep all documents up to date: Check that all documents are current and not expired.

- Keep copies of all documents: Make copies of all documents before submitting them so that you have a record of what you submitted.

- Check for errors: Review all documents for any errors, typos, or inconsistencies before submitting.

- Submit legible copies: Ensure all documents are clear, readable, and not blurry.

- Submit all documents at once: Submit all required documents together to avoid any delays or issues with the registration process.

- Follow the instructions: Follow the instructions provided by the Udyam MSME registration portal carefully to ensure a smooth process.

By following these tips, you can confidently prepare and submit your documents and increase the chances of a successful Udyam MSME registration.

Step-by-Step Guide to Udyam MSME Registration

A detailed explanation of the step-by-step process for Udyam MSME registration

The Udyam MSME registration process is an online process and can be done by following the steps given below:

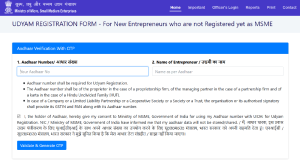

Step 1: Visit the Udyam Registration portal (https://udyamregistration.gov.in) and select the “For New Entrepreneurs who are not Registered yet as MSME” option.

Step 2: Enter your Aadhaar number and name as per Aadhaar, and click on “Validate & Generate OTP.” Once you receive the OTP on your Aadhaar registered mobile number, enter it in the space provided and click on “Validate OTP.”

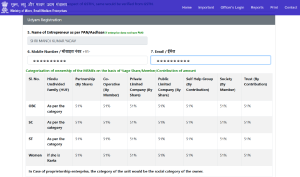

Step 3: Next, fill in the Udyam Registration form with all the necessary details, such as PAN number, business name, and other details. Upload a scanned copy of the PAN card and other required documents.

Step 4: Review the information provided in the form, and if all the information is correct, click on the “Submit” button.

Step 5: Make the payment for the Udyam registration through the online payment portal. The registration fee varies based on the type of business and the turnover of the business.

Step 6: Once the payment is successful, you will receive an Udyam Registration Number (URN) on your registered email and mobile number.

By this, You have successfully completed the Udyam MSME registration process.

It is important to note that the registration process may take up to 1-2 working days for processing. If there are any issues or errors in the registration, the application may be rejected, and you will have to reapply with the correct information.

Common issues faced during the Udyam MSME registration process and their solutions

While the Udyam MSME registration process is designed to be straightforward, some common issues may arise during the process. Here are some common problems and their solutions:

- Issues with Aadhaar authentication: Check your Aadhaar data and cellphone number to see whether they are correctly input if your Aadhaar authentication attempts fail. You can ask for support from the Udyam registration helpline if the problem continues.

- Incorrect or incomplete information: Make sure all of the data you enter on the Udyam registration form is accurate and complete. Verify that all of the uploaded documents are readable and in the right format.

- Payment issues: Make sure you have a reliable internet connection and enough money in your account in case you experience any payment-related problems. Use a different payment method or try making the payment once more. Contact the Udyam registration support centre for assistance if the problem continues.

- Rejection of application: Review the reasons for rejection if your application was turned down and make any necessary corrections. You can submit a new application with the correct details or ask for help from the Udyam registration helpline.

- Technical issues: Try deleting your cache and cookies or switching to a different browser if you have any technical problems when registering, such as website difficulties or sluggish loading times. Contact the Udyam registration support centre for assistance if the problem continues.

By being aware of these common issues and their solutions, you can ensure a smooth and hassle-free Udyam MSME registration process.

Tips for a smooth Udyam MSME registration process

Here are some tips for a smooth Udyam MSME registration process:

- Have all necessary documents and information ready before starting the registration process.

- Verify that all details entered are correct and complete.

- Use a stable internet connection and a reliable device to avoid technical issues.

- Keep a record of your Udyam Registration Number (URN) and other important details.

- If you face any issues, contact the Udyam registration helpdesk for assistance.

- Be patient and allow 1-2 working days for processing.

- Regularly check for updates or communication from the Udyam registration portal.

Benefits of Udyam MSME Registration

A detailed explanation of the benefits of Udyam MSME registration for businesses

Udyam MSME registration offers several benefits for businesses, including:

- Eligibility for government schemes and subsidies: Registered MSMEs can apply for various government schemes and subsidies, such as credit guarantee schemes, marketing assistance, and technology upgradation.

- Preference in government tenders: Udyam registered MSMEs are given preference in government tenders, which can significantly boost their business.

- Access to credit: Udyam registered MSMEs can avail of loans at lower interest rates through various government schemes like CGTMSE, Mudra Loan, Stand-up India, and others.

- Protection against delayed payments: MSMEs registered under Udyam are eligible to file complaints regarding delayed payments by buyers under the MSME Development Act 2006, which helps in protecting them from financial stress.

- Increased market visibility: Udyam registration helps MSMEs increase their visibility in the market, leading to increased credibility and trust among customers and suppliers.

- Access to online marketplaces: Udyam registration allows MSMEs to participate in various e-commerce marketplaces like Amazon, Flipkart, and others, which can help them expand their reach and customer base.

- Compliance benefits: Udyam registration provides several compliance benefits, such as easier access to statutory registrations and licenses, which can save MSMEs time and money.

Advantages of Udyam MSME registration in availing government schemes and benefits

Udyam MSME registration provides several advantages for businesses to avail of various government schemes and benefits. By registering, MSMEs can access a range of schemes and subsidies offered by the government, including credit guarantee schemes, marketing assistance, technology upgradation, and financial assistance.

Additionally, registered MSMEs can avail of various loans at lower interest rates through government schemes like CGTMSE, Mudra Loan, and Stand-up India. The registration also provides priority in government tenders, which can help MSMEs increase their revenue and expand their reach. By availing of these benefits, MSMEs can grow their business and increase their chances of success in the competitive market.

Role of Udyam MSME registration in securing loans and financing

Udyam MSME registration plays a crucial role in securing loans and financing for businesses. By registering under Udyam, MSMEs can avail of several government schemes and subsidies, including credit guarantee schemes and other financial assistance. These schemes provide MSMEs with easier access to loans at lower interest rates, making it easier for them to secure financing and meet their financial needs.

Additionally, Udyam MSME registration provides credibility and legitimacy to businesses, making it easier for them to attract potential lenders and investors. Banks and other financial institutions often prefer to lend to registered MSMEs, as they are viewed as reliable and trustworthy.

Furthermore, registered MSMEs can also leverage their registration status to access various online marketplaces and e-commerce platforms, which can help them expand their reach and increase their revenue.

Udyam MSME registration plays a crucial role in securing business loans and financing by providing access to government schemes, enhancing credibility and legitimacy, and increasing market visibility.

Common Mistakes to Avoid During Udyam MSME Registration

Common mistakes made during the Udyam MSME registration process

Some of the common mistakes made during the Udyam MSME registration process include the following:

- Providing incorrect information such as investment or turnover figures

- Not updating the registration details after any changes in business activities or details

- Choosing the wrong category or sub-category for the MSME registration

- Uploading incorrect or incomplete documents

- Providing an incorrect PAN or GST number

- Not verifying the OTP or email confirmation during the registration process

- Submitting multiple applications for the same entity

- Not following the guidelines and instructions specified by the government during the registration process.

Tips for avoiding these mistakes and ensuring a smooth registration process

Here are some tips to avoid mistakes and ensure a smooth Udyam MSME registration process:

- Read and understand the government’s guidelines and instructions before starting the registration process.

- Ensure that the information provided is accurate and up-to-date, especially investment and turnover figures.

- Choose the correct category and sub-category for MSME registration based on the revised criteria.

- Verify all information and documents before applying.

- Prepare all necessary documents, such as PAN card, GST registration certificate, and cancelled cheque or bank statement.

- Ensure that the registered mobile number and email address are correct and accessible to receive the OTP and email confirmation.

- Avoid submitting multiple applications for the same entity.

- Seek professional help if required to ensure a smooth and error-free registration process like Kanakkupillai. Contact us now and get your business registered!!

By following these tips, businesses can avoid common mistakes and ensure a hassle-free Udyam MSME registration process.

Udyam MSME Registration and Its Impact on the Indian Economy

Role of MSMEs in the Indian Economy

They are considered the backbone of the economy, contributing significantly to employment generation, export promotion, and overall growth and development of the country. Here are some key roles played by MSMEs in the Indian economy:

- Employment generation: MSMEs provide employment opportunities to many people in rural and semi-urban areas. They are the largest employers after agriculture, contributing to nearly 120 million jobs in India.

- Contribution to GDP: MSMEs make significant contributions to the country’s GDP. They contribute around 30% to India’s GDP and around 40% to its total exports.

- Innovation and entrepreneurship: MSMEs are known for their innovative and entrepreneurial spirit. They often drive new ideas, products, and services in the market, leading to increased competition and growth.

- Regional development: MSMEs play a crucial role in developing backward and rural areas, providing opportunities for economic development and reducing regional disparities.

- Export promotion: MSMEs are major contributors to India’s exports, with a significant share of the country’s total exports coming from the sector.

Overall, MSMEs are essential to the Indian economy, driving growth, employment, and innovation.

Significance of Udyam MSME registration in promoting the growth of MSMEs in India

Udyam MSME registration is a significant step in promoting the growth of MSMEs in India. Here are some of the ways in which Udyam registration is significant in promoting the growth of MSMEs:

- Access to government schemes and benefits: Udyam registration enables MSMEs to avail of various government schemes and benefits such as subsidies, tax exemptions, credit facilities, and other incentives.

- Visibility and credibility: Udyam registration gives MSMEs a unique identification number and enhances their visibility and credibility. It helps in establishing trust among customers, suppliers, and financial institutions.

- Ease of doing business: Udyam registration simplifies the process and reduces the time and cost of obtaining various clearances, approvals, and licenses required for doing business.

- Access to finance: Udyam registration helps MSMEs access credit facilities from financial institutions at lower interest rates and better terms.

- Facilitates technology adoption and innovation: Udyam registration promotes technology adoption and innovation by enabling MSMEs to participate in government initiatives such as Make in India, Start-up India, and Digital India.

Impact of Udyam MSME Registration on the Indian Economy

Udyam MSME registration significantly impacts the Indian economy by promoting the growth and development of MSMEs. By enabling MSMEs to access government schemes, finance, technology, and markets, Udyam registration contributes to the country’s overall economic growth and development. It also creates employment opportunities, promotes innovation and entrepreneurship, and reduces regional disparities. Udyam registration is expected to play a crucial role in achieving the government’s goal of a self-reliant India by promoting domestic manufacturing and exports and reducing dependence on imports.

Conclusion:

In conclusion, Udyam MSME registration is a crucial step towards promoting the growth and development of MSMEs in India. It simplifies the registration process and enables businesses to access various government schemes and benefits, which can significantly contribute to their success.

By enhancing their visibility and credibility, Udyam registration also helps companies to establish trust and build strong relationships with their customers, suppliers, and financial institutions. With the government’s emphasis on promoting domestic manufacturing and reducing dependence on imports, Udyam MSME registration is expected to play a crucial role in achieving the goal of a self-reliant India. Overall, Udyam MSME registration is a significant milestone in promoting entrepreneurship, innovation, and economic growth in India.