HSN Code Finder

| HSN Code | HSN Description |

|---|---|

| Result will appears here... | |

HSN Code Finder

Harmonised System of Nomenclature (HSN) numbers are a way for over 200 countries and markets around the world to agree on how to classify things. A common and organised way to identify and group a lot of different products, from raw materials to finished things, is with these 6-digit numbers. The main goal of HSN codes is to make foreign trade easier by making it easier to clear customs, pay taxes correctly, and handle operations. By creating a standard way to identify products, HSN numbers make it easier to do business across borders, lower the chance of mistakes, and increase openness in the global market. As companies deal with the complicated world of international trade, knowing and using HSN codes properly is becoming more and more important for staying compliant, staying competitive, and integrating into the global supply chain.

Understanding HSN Codes

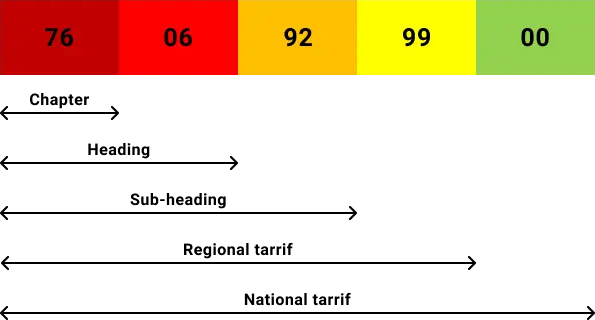

Harmonised System of Nomenclature (HSN) names are an important part of international trade because they make it easy to group things across countries in a consistent way. These numbers have between 6 and 8 digits, and each digit represents a different level of classification based on the product's features, make-up, and intended use. The layout of HSN codes is tiered, with larger groups at the beginning and more specific classifications towards the end, allowing for exact identification of goods within different businesses. This uniform classification system is crucial for accurate product labelling, tracking, and paperwork, ensuring stability in trade practices and tax rates globally.

HSN codes play a crucial role in easing customs processes, improving transportation management, and allowing quick customs clearance by providing a uniform language for product labelling. By standardising the classification of goods, HSN codes simplify foreign trade processes, reduce mistakes, and increase openness in the marketplace, helping companies, customs officials, and customers alike. Understanding the structure and meaning of HSN codes is fundamental for companies involved in cross-border trade, as it not only helps in compliance with legal requirements but also fosters faster transactions and fosters international competitiveness.

Role of HSN Code Finder

HSN Code Finder are digital tools created to help companies and people in quickly finding the proper HSN (Harmonized System of Nomenclature) codes for their goods. These tools leverage the organised system of HSN codes to provide users with the right 4-digit or 6-digit HSN code based on the features and description of their goods. By streamlining the process of HSN code recognition, these tools help ease compliance, reduce mistakes, and improve the accuracy of product classification.

Benefits of HSN Code Finder

- Improved Compliance: HSN tools ensure correct HSN code selection, allowing companies to meet with legal requirements for GST filing and customs processes.

- Reduced mistakes: By removing hand lookups and calculations, HSN tools reduce the risk of human mistakes in product classification.

- Enhanced Efficiency: The automatic nature of HSN tools saves time and resources, allowing companies to focus on their core activities.

- Consistent Classification: HSN tools provide a standardized approach to product classification, supporting unity across an organization's assets and transactions.

- fluid Integration: Many HSN tools are linked with e-commerce platforms and financial software, allowing fluid data sharing and improved business processes.

How to Use HSN Code Finder

Using HSN tools efficiently requires an organised method to ensure accurate results for product labelling and tax compliance. Here is a step-by-step guide on utilizing HSN tools effectively:

- Access the Calculator: Begin by finding a trusted HSN Code Finder tool such as those offered by experts to start the sorting process.

- Enter Product information: Input specific information about the product, including its description, composition, and intended use, into the tool for exact labelling.

- Select the Correct Category: Choose the proper category or area that best matches with the object being described within the HSN code directory.

- Review the created Code: Once the necessary information is entered, review the HSN code created by the tool to ensure it accurately describes the product for tax and customs reasons.

Tips for Accurate Results:

- Double-check product details and specs to match them correctly with the HSN code index.

- Regularly update the tool with new product information to keep compliance with changing laws.

- Seek expert advice or speak with pros for complicated or unclear product labels to ensure correctness and compliance.

Practical Applications

HSN tools play a vital role in real-world scenarios, helping businesses in GST compliance and tax filing processes with accuracy and speed. By utilizing HSN tools, businesses can correctly determine the appropriate HSN numbers for their goods, ensuring compliance with GST laws and allowing smooth tax filing procedures. For instance, when a business sells LED TVs, the HSN tool can quickly create the specific HSN code (e.g., 85 28 12 11), allowing the company to group its goods correctly for taxes reasons. This accurate labelling not only speeds the billing process but also ensures that the correct GST rates are applied, lowering the risk of mistakes and penalties during audits and customs procedures.

Moreover, HSN tools ease the task of keeping new HSN numbers for different goods, allowing businesses to stay legal with changing laws and tax requirements. By simplifying the classification process, these tools save time and resources, allowing companies to focus on core operations while ensuring accurate and consistent reporting for GST compliance and tax filing responsibilities. In essence, the practical uses of HSN Code Finder stretch beyond mere classification; they serve as essential tools for businesses looking to handle the difficulties of GST laws and taxes with ease and accuracy.

Impact of HSN Codes on Businesses

Accurate classification of HSN (Harmonized System of Nomenclature) numbers greatly improves business operations and foreign trade by offering a regulated and organised method to product identification and classification. Properly given HSN numbers simplify inventory management, allowing companies to group goods easily and track them effectively, leading to better transportation and operational processes. In international trade, exact HSN code classification helps customs processes, ensuring smooth clearance of goods across borders and lowering the risk of delays or arguments due to wrong categorization.

Moreover, correct HSN code classification improves openness in business deals, as it offers a shared language for product recognition and taxes, fostering trust and reliability in trade relationships. By sticking to the correct HSN codes, businesses display compliance with regulatory requirements, reducing the risk of fees and legal issues, and showing their commitment to responsible business practices. Overall, the meticulous application of HSN codes not only simplifies tax calculations and pricing strategies but also supports market expansion efforts by enabling businesses to identify and respond to demand in different regions, ultimately contributing to their competitiveness and success in the global marketplace.

Common Mistakes to Avoid

Based on the search findings, some common mistakes businesses should avoid when using HSN tools include:

- Entering incorrect or missing product details: Failing to provide accurate descriptions, mixtures, and planned uses of goods can lead to the wrong HSN code being produced.

- Selecting the wrong product category or section: Choosing an unsuitable category within the HSN code directory can result in faulty labelling.

- Not regularly updating the tool with new product information: Outdated product data can cause businesses to use outdated HSN codes, leading to compliance problems.

Future Trends

As the global trade environment continues to change, the role of HSN (Harmonized System of Nomenclature) numbers and tools is likely to become increasingly vital for businesses. Several key trends are affecting the future of HSN codes and their related tools:

- Increased Automation: HSN tools are likely to become more complex, leveraging advanced algorithms and machine learning to provide even more accurate and efficient product classification.

- Integration with Digital Platforms: HSN tools will easily connect with e-commerce platforms, financial software, and supply chain management systems, allowing real-time data sharing and improved business operations.

- Expanded Global Adoption: As more countries and economies accept the HSN system, the need for standardised product classification will grow, causing the development of more thorough and user-friendly HSN tools.

- Enhanced Compliance Monitoring: Regulatory authorities may leverage HSN codes and tools to enhance compliance monitoring, ensuring companies comply to changing trade laws and tax requirements.